TSA Group – Automation Readiness Assessment

Customer Science completed a review using our proven Process Discovery and Automation Readiness Assessment methodology

Project

Project Date: 2023

Background: TSA Group are a leading Australian CX and call centre outsourcing provider. TSA requested that Customer Science Group conduct an assessment across their Workforce Management, HR & Compliance and Contact Centre teams to identify opportunities to improve efficiency, service delivery, employee and customer experience, and reduce attrition through process automation.

Results

Solution: Customer Science Group completed a review using our proven Process Discovery and Automation Readiness Assessment methodology. It is a framework that:

Results: We concluded that TSA Group has an excellent opportunity to harness the power of automation to drive efficiency, improve service quality and increase employee satisfaction across the Contact Centre and Ops teams. Out of 39 reviewed processes, we shortlisted 20 potential opportunities for automation.

We provided TSA Group with:

Results: We concluded that TSA Group has an excellent opportunity to harness the power of automation to drive efficiency, improve service quality and increase employee satisfaction across the Contact Centre and Ops teams. Out of 39 reviewed processes, we shortlisted 20 potential opportunities for automation.

We provided TSA Group with:

- Assesses where to focus effort through an organisation-wide “AI and Automation Heatmap”

- Identifies suitable candidate opportunities for process improvement through automation

- Identifies potential opportunities for cost reduction, increased revenue, efficiency, speed and accuracy, and improved staff and customer experience

- Results in a findings report outlining automation potential, key findings, recommendations and a prioritised implementation roadmap

-

The review was conducted by first soliciting an organisational chart to plan and schedule the assessment

-

We ran workshops/process discovery sessions with key TSA stakeholders to introduce the Process Diagnostic methodology and gain their perspectives

-

Shared a survey (Process Identification Template) to all workshop and session attendees to pre-canvas their ideas for automation

-

Conducted a series of sessions/ride-alongs covering TSA Team Leaders, Ops Managers and Recruitment/People teams to review processes

- In determining the automation potential of specific processes, we examined key factors of benefit potential, data inputs and outputs, process standardisation and business rules

-

Captured Process information into a ‘Book of Work’

-

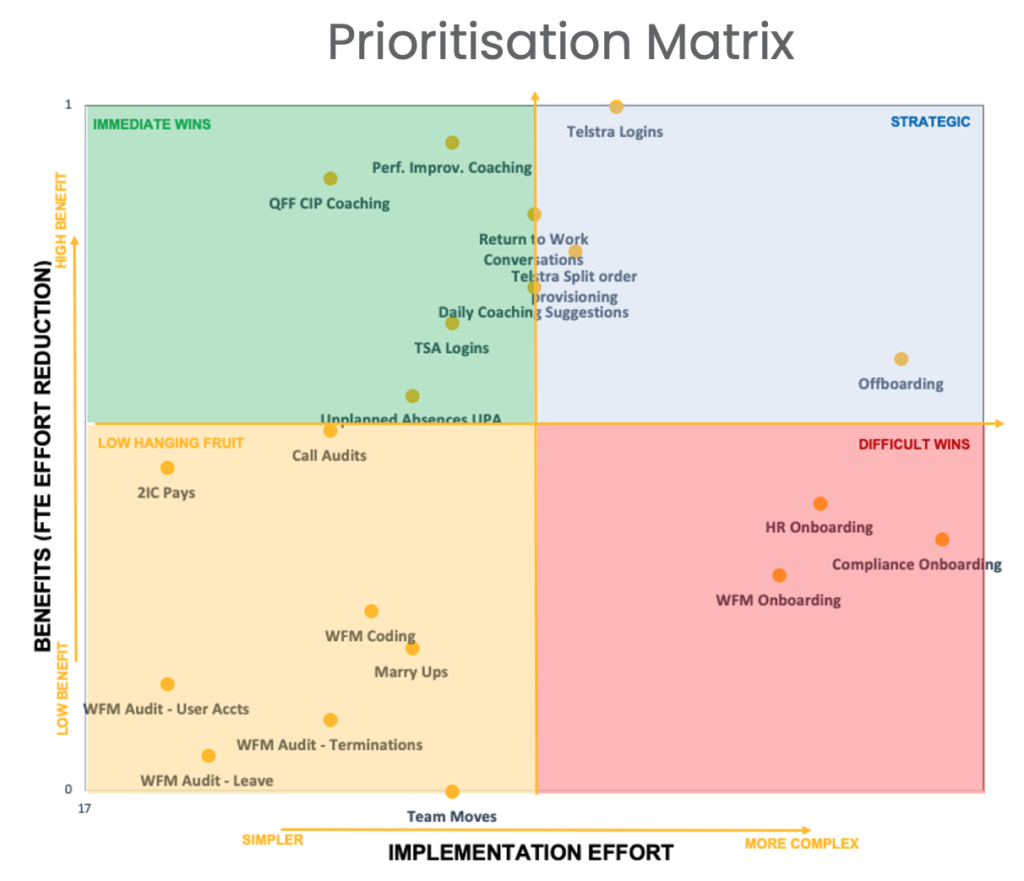

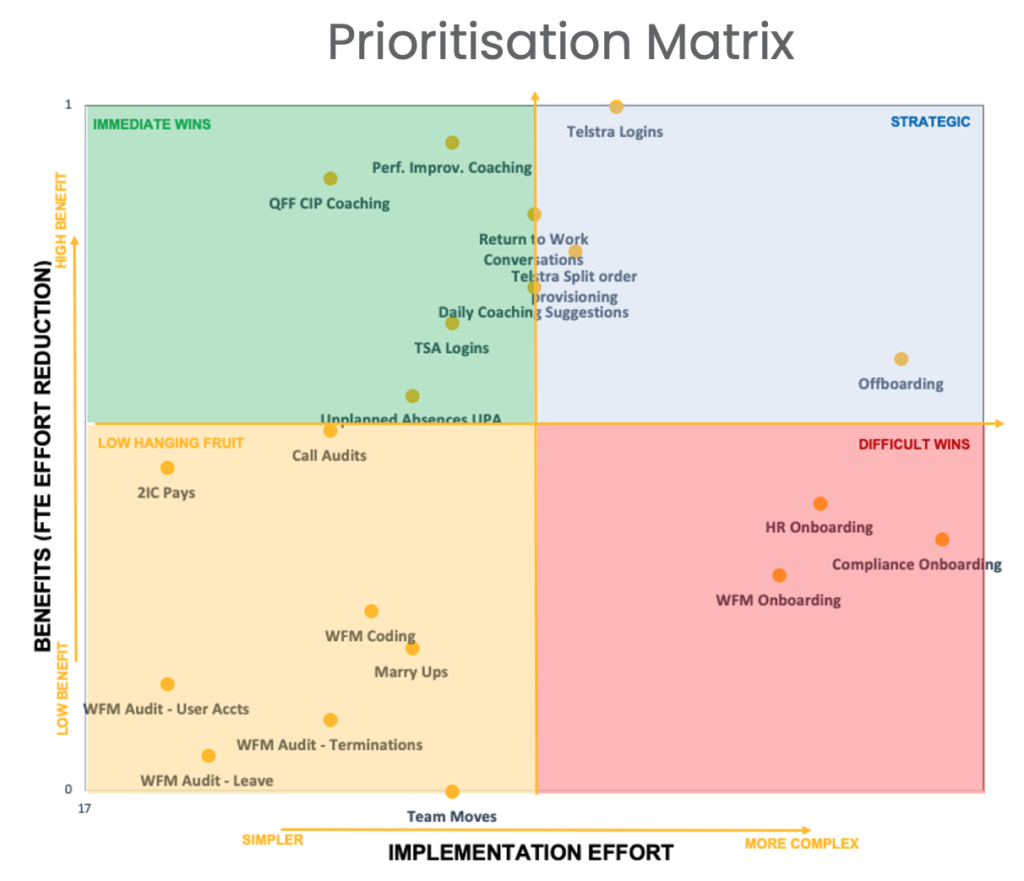

Performed a potential benefit & complexity assessment across the identified opportunities

-

Performed a high-level business case assessment that considers implementation and ongoing UiPath Business Automation Platform licensing & support costs

-

Developed a roadmap for the implementation of the automated processes in the Book of Work

Results: We concluded that TSA Group has an excellent opportunity to harness the power of automation to drive efficiency, improve service quality and increase employee satisfaction across the Contact Centre and Ops teams. Out of 39 reviewed processes, we shortlisted 20 potential opportunities for automation.

We provided TSA Group with:

Results: We concluded that TSA Group has an excellent opportunity to harness the power of automation to drive efficiency, improve service quality and increase employee satisfaction across the Contact Centre and Ops teams. Out of 39 reviewed processes, we shortlisted 20 potential opportunities for automation.

We provided TSA Group with:

- Comprehensive Report outlining the findings from the observation and analysis stages, insights on current processes, bottlenecks, and inefficiencies

- Business case detailing the potential benefits, investment requirements, ROI estimates, risks & mitigation strategies for the top 3 proposed automation solutions.

- Prioritised list of recommendations, with a rationale for each suggestion, such as impact on customer experience, cost savings & implementation feasibility.

- Detailed implementation plan for a pilot, including timelines and resources