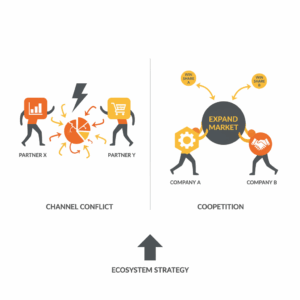

What do executives mean by channel conflict and coopetition?

Leaders use channel conflict to describe disputes among route-to-market partners whose actions undermine each other’s sales, margin, or market share objectives. In practical terms, conflict emerges when a manufacturer, distributor, or retailer perceives that another participant’s tactics prevent it from meeting its own goals. Classical marketing research treats channel conflict as a measurable construct with links to performance, though empirical findings about the conflict–performance relationship have been mixed across decades of studies.¹ Coopetition describes interorganizational relationships that combine cooperation and competition at the same time. The term gained prominence through strategy work that framed markets as games with players who sometimes collaborate to expand the pie while still competing to win slices.² More recent scholarship has clarified that true coopetition requires simultaneous competition and cooperation between capable rivals toward a shared outcome, rather than generic partnerships or loose cooperation.³

Why do these dynamics intensify in omnichannel ecosystems?

Digital ecosystems compress distance between producers and customers, which multiplies both friction and opportunity. As firms add direct-to-consumer storefronts, marketplace listings, partners, and resellers, overlapping touchpoints generate pricing pressure, assortment inconsistencies, and service confusion, all of which heighten the probability of channel conflict. Meta-analyses show that definitions and measures of conflict vary, which partly explains why conflict sometimes correlates with better coordination and, at other times, with degraded outcomes.¹ At the same time, ecosystem strategies promise attractive growth and resilience by knitting together complementary services around customer jobs to be done. Executives who orchestrate ecosystems report tangible, near and long term value, provided they choose focused plays and align incentives across players.⁴ The managerial tension is clear. Ecosystems increase total addressable demand, while omnichannel overlap increases the risk of partners colliding.

How do the mechanisms differ: conflict mechanics vs coopetitive design?

Conflict mechanics usually follow a predictable arc. Goal misalignment triggers perceived unfairness, which prompts retaliatory pricing, restricted access, or information hoarding, and then outcomes fall as partners disengage. Governance focuses on dispute resolution, role clarity, and incentive redesign.¹ Coopetitive design follows a different logic. Rival firms identify a shared platform, standard, or network where collaboration increases total value, then compete on differentiated layers such as product features, service, or brand. Foundational research argues that coopetition expands the pie for all participants by changing the game, not just the moves, and then restores competition at the edge where customer choice is decided.² Systematic reviews codify levels and phases of coopetition across projects, business units, and networks, and emphasize the need to manage knowledge flows, appropriation risk, and partner symmetry to avoid value leakage.⁵

Where do leaders see each in the real world?

Executives encounter channel conflict most visibly on large marketplaces. Regulators in the European Union investigated whether a platform’s dual role as marketplace and retailer created conflicts of interest, particularly where platform data and design choices might disadvantage third party sellers.⁶ Ongoing scrutiny from national competition authorities reinforces that channel rules can tilt outcomes for or against partners, which affects trust and participation.⁷ By contrast, airline alliances illustrate coopetition at scale. Star Alliance coordinates schedules, loyalty recognition, and lounge access among more than two dozen member airlines so travelers experience global connectivity that no single carrier can deliver alone, while individual airlines still compete on routes, pricing, and service.⁸ In technology supply chains, component deals can pair fierce rivals as indispensable partners. Industry reporting has repeatedly documented Samsung Display supplying OLED panels for Apple devices, which aligns incentives to grow premium categories even as both companies compete in phones, tablets, and laptops.⁹

What are the risks and governance traps?

Leaders face three common traps when managing conflict and coopetition. First, measurement bias confuses noise for signal. Because studies operationalize conflict differently, executives who cherry pick findings can justify either inaction or excessive control. A disciplined view acknowledges that the conflict–performance link is contingent on channel structure, power balance, and enforcement clarity.¹ Second, rule ambiguity invites gaming. Marketplace operators and brand owners who do not codify pricing, attribution, assortment, and service standards invite escalation and churn.⁶ Third, knowledge leakage undermines coopetition. Reviews of coopetition research warn that value creation depends on guarding proprietary know how while still enabling the shared platform.³⁵ Successful orchestrators use clean room data, firewalled teams, and time boxed technology exchanges to manage risk without stalling collaboration.

How should we measure commercial impact without bias?

Executives should separate three layers of evidence. Descriptive metrics capture where conflict occurs, such as price dispersion by channel, listing duplication, or service variance. Explanatory metrics test causal mechanisms, such as whether marketplace policy changes shift partner margins. Outcome metrics tie conflict or coopetition to revenue growth, cost to serve, churn, and Net Promoter changes. Research synthesizing more than one hundred empirical papers shows that inconsistent constructs and measures often cloud the conflict–performance picture, so leaders need a common index and a repeatable cadence.¹ Applied methods such as a marketing channel conflict index provide a starting point by scoring intensity across drivers like pricing violations, territory overlap, and inventory allocation. While such indices require tailoring, they improve comparability over time and force explicit thresholds for intervention.¹⁰ Systematic reviews of coopetition suggest tracking value creation at both the joint and firm levels to ensure that shared gains do not mask asymmetric leakage.⁵

Which operating model helps you convert conflict into disciplined coopetition?

Leaders should design a two speed operating model. The conflict track enforces rules with clear escalation paths, transparent penalties, and swift remediation. This track focuses on incentives and fairness perceptions, since trust erosion is hard to reverse.¹ The coopetition track invests in joint assets that expand customer value, such as shared standards, loyalty reciprocity, or co marketed bundles, while preserving areas of head to head differentiation. Airline alliances demonstrate how common infrastructure can scale while leaving room for competitive choice.⁸ Ecosystem guidance from growth research adds an important lens. Orchestrators should prioritize use cases with high customer willingness to adopt bundled services, align partner economics, and define explicit exit ramps to prevent lock in that sours relationships.⁴ Strategic discipline comes from repeating definitions, governance artifacts, and measurement across business units so managers speak the same language.

What is the executive playbook for the next 90 days?

Executives can sequence decisions to create momentum without overhauling the enterprise. First, publish channel definitions and a three tier conflict taxonomy that maps behaviors to consequences, then socialize through account management routines.¹ Second, deploy a lightweight conflict index and baseline current intensity across product lines and geographies, then set green, amber, and red thresholds tied to specific actions.¹⁰ Third, pick one coopetition opportunity where a joint platform could unlock reach or quality, such as reciprocal loyalty or shared service coverage, and assign a cross functional team to deliver a narrow, testable pilot.⁵⁸ Fourth, engage legal and compliance early where platforms or marketplaces operate at scale, since evolving oversight can change the economics of channel design and partner strategy.⁶⁷ The right cadence turns conflict into a source of insight and turns coopetition into a reliable capability rather than an ad hoc deal.

How will this shift customer outcomes and enterprise value?

Customer experience improves when partners stop fighting over ownership and start competing to deliver clarity, speed, and reliability. Ecosystem work shows that when orchestrated well, bundled services increase engagement and reduce friction across journeys, which supports growth and resilience.⁴ Channel rules that prevent price whiplash and service inconsistency reduce effort and complaints, which often lowers cost to serve. When coopetition is designed with guardrails, shared infrastructure such as alliances or component ecosystems can expand choice without degrading differentiation. Evidence from alliances and technology supply chains suggests that scale benefits do not require uniformity, provided governance preserves freedom to compete where it matters.⁸⁹ The commercial impact then follows a simple logic. Clear conflict governance protects the pie from erosion, and disciplined coopetition expands the pie for participating firms and their customers.²

FAQ

What is channel conflict in customer experience operations?

Channel conflict is a dispute among distribution partners whose actions impede each other’s sales, margin, market share, or service goals. Research shows definitions and performance effects vary, which means leaders must standardize measures before drawing conclusions.¹

What is coopetition and how is it different from a standard partnership?

Coopetition is a relationship where rivals cooperate on shared assets while competing on differentiated offerings at the same time. Foundational strategy work and recent reviews emphasize simultaneous cooperation and competition as the defining feature.²³

Why do omnichannel strategies increase channel conflict risk?

Omnichannel adds overlapping touchpoints and incentives, which increases pricing pressure, assortment inconsistencies, and service confusion. Meta-analytic evidence highlights inconsistent measures, so governance and measurement discipline are essential.¹

Which real world examples illustrate coopetition at scale?

Airline alliances coordinate schedules and loyalty benefits across more than two dozen member airlines, while carriers still compete on routes and service. Technology supply chains show rivals partnering on components, such as OLED displays supplied for Apple devices.⁸⁹

How should executives measure the impact of channel conflict and coopetition?

Leaders should track descriptive, explanatory, and outcome metrics. A structured conflict index can score intensity across drivers, while coopetition should be measured at both joint and firm levels to detect asymmetric value capture.¹⁰⁵

Why do regulators examine marketplaces for channel conflicts of interest?

Authorities in the European Union and national regulators have scrutinized whether a platform’s dual role as marketplace operator and retailer disadvantages third party sellers, which affects partner trust and customer outcomes.⁶⁷

Which first steps convert destructive conflict into productive coopetition?

Publish clear rules and consequences, baseline conflict with an index, launch a narrow coopetition pilot on a shared asset, and align with legal early to match evolving oversight. This sequence builds trust while protecting competitive integrity.¹⁰⁵⁶

Sources

Conflict and performance in channels: a meta-analysis. Palmatier, R. W., Stern, L. W., El Ansary, A., et al. 2020. Journal of the Academy of Marketing Science. https://link.springer.com/article/10.1007/s11747-020-00751-1

Co-opetition. Brandenburger, A. M., Nalebuff, B. J. 1996. Crown Business (book). https://en.wikipedia.org/wiki/Co-opetition_%28book%29

What coopetition is and what it is not: Defining the hard core. Chiambaretto, P., Fernandez, A. S., Le Roy, F. 2022. Strategic Management Review. https://www.strategicmanagementreview.net/assets/articles/Chiambaretto%2C%20Fernandez%2C%20and%20Le%20Roy.pdf

Growth and resilience through ecosystem building. Manyika, J., et al. 2023. McKinsey & Company. https://www.mckinsey.com/capabilities/growth-marketing-and-sales/our-insights/growth-and-resilience-through-ecosystem-building

Levels, phases and themes of coopetition: A systematic literature review and research agenda. Bouncken, R. B., Gast, J., Kraus, S., Bogers, M. 2016. Industrial Marketing Management. https://www.sciencedirect.com/science/article/pii/S0263237316300251

The EU’s competition investigation into Amazon Marketplace. Wolters Kluwer Competition Law Blog. 2019. https://legalblogs.wolterskluwer.com/competition-blog/the-eus-competition-investigation-into-amazon-marketplace/

Amazon’s Pricing Mechanism Could Breach Competition Law, German Regulator Says. Schechner, S. 2024. The Wall Street Journal. https://www.wsj.com/business/retail/amazons-pricing-mechanism-could-breach-competition-law-german-regulator-says-3b887418

Members. Star Alliance. 2025. https://www.staralliance.com/en/members

Samsung Fulfilling Nearly All of Apple’s iPhone 15 OLED Display Orders. Clover, J. 2023. MacRumors. https://www.macrumors.com/2023/09/12/iphone-15-oled-display-orders-dominated-by-samsung/

Constructing Marketing Channel Conflict Index (MCCI): A Complete Method. Alam, S. I. 2021. Lecture note, ResearchGate preprint. https://www.researchgate.net/profile/Sm-Ikhtiar-Alam/publication/348663423_Constructing_Marketing_Channel_Conflict_Index_MCCI_A_Complete_Method/links/6009f7d692851c13fe2a858f/Constructing-Marketing-Channel-Conflict-Index-MCCI-A-Complete-Method.pdf